Time to Pay Attention to your Mortgage - Refinance Now!

)

You probably have heard that there are changes to the mortgage rules that take effect January 1, 2018. Though, you might be confused on how these changes impact you. The most noticeable impact will be when you want to refinance your mortgage.

Starting January 1, 2018, when you decide that you want to refinance your mortgage you will have to qualify at a much higher interest rate. This higher qualifying rate, referred to as a stress test, is the greater of the five-year benchmark rate published by the Bank of Canada (currently 4.99%) OR the lender contractual mortgage rate plus 2.0%.

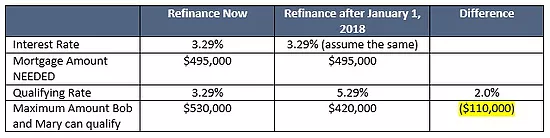

Let's look at an example and compare refinancing now versa refinancing after January 1, 2018:

Example:

Bob and Mary have a $450,000 mortgage which they want to refinance and pay off some high-interest credit card debt of $45,000. Their house is worth $850,000, and their household income is $90,000.

In this example, after January 1, 2018, Bob and Mary will only qualify for a $420,000 mortgage amount. They will not be able to pay off their high-interest credit card debt by refinancing. They have a lot of equity in their home, but cannot access it through traditional lending. They will need to look for alternative means to access the equity.

It is essential for Bob and Mary to take advantage of this refinancing window now such that they can pay off their credit card debt and secure a new mortgage.

Are you thinking about refinancing your mortgage? Get your questions answered and start a conversation with Sean today.

Sean Stewart, Mortgage Agent

P: 905-427-9596

E: sean@ashbunmortgages.com

W: ashburnmortgages.com

| Tags:Latest News |

What our clients say

News and press releases

Why Every Small Business in Durham Region Needs a Website

)

Simplify your hiring process – attract and find qualified candidates

)

DURHAM NETWORKING - The Benefits of Networking in your Community

)